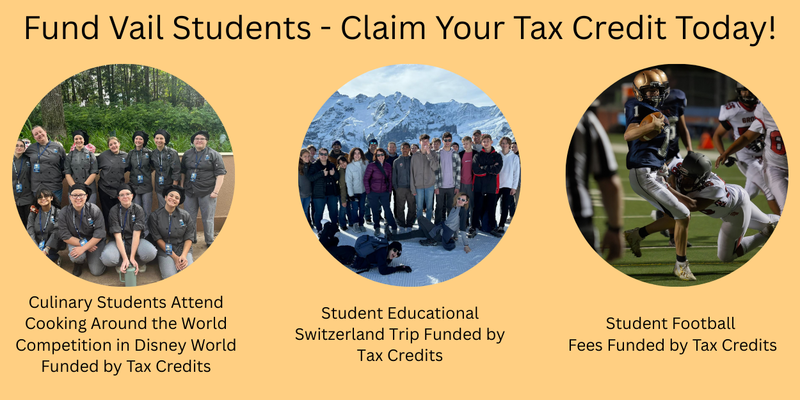

It is well known that students who are connected through athletics, fine arts, clubs, or other extracurricular activities are more likely to feel a strong sense of belonging and connection to their school and others within their school communities. Thank you to each of you who provide opportunities for young people to thrive through your generous tax credits each year!

Each year, we have the opportunity to open unimaginable doors to our students. We can direct a portion of our Arizona taxes to specific students, the clubs or activities in which they participate, or a school’s general needs fund.

It’s easy! Keep your Arizona state income tax in Vail and decide how YOU want it to be used. Visit vailtaxcredits.org, select a school, and shop for the activity you’d like to fund. You can select any dollar amount up to $400 (married filing jointly) or up to $200 (filing single). Then simply claim it for a dollar-for-dollar credit on your Arizona taxes. Right now, you can claim your 2025 tax credit through April 15, 2026 if you haven’t done so for 2025.

However you direct your Arizona Tax Credit, that amount can only go towards supporting the activity that you choose. It’s one of the best ways we have to directly control where our tax dollars are spent. Thank you for your consideration in investing those dollars to better the lives of our own students.

Select a school and shop for the activity you’d like to fund. This is just one more way for each of us to participate in Vail's motto - Where Education Is a Community Effort!